Online NTN Inquiry For FBR Registration of NTN

Online Verify Your FBR NTN within 2 Minutes!

Online verification of your FBR NTN is very easy. It would take just 2 minutes. The inquiry ” How to verify my NTN online from FBR?” and “what is NTN verification?”, “How to check my NTN status online?” is answered here.

Pakistani citizens are legally required to register their NTN if they wish to receive their salary through banking channels and if they wish to file income tax returns. It is mandatory for all citizens doing businesses and also who are earning a taxable income over PKR 400,000.

What does it mean to have your NTN verified?

Some clients also ask us what does it mean to have an NTN verified? Having your NTN number verified by the FBR means that you are eligible to pay income tax, sales tax, and other taxes. If you are earning money, then it is important to have this done.

If you don’t want a penalty from the FBR, it’s crucial to file your income tax return after verifying your NTN online and get this done as soon as possible. There are various ways that this can be done.

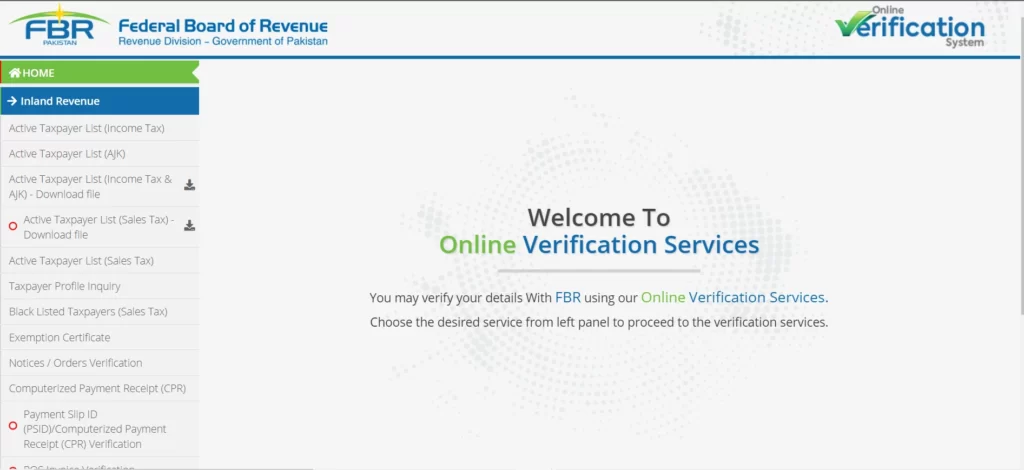

You can verify your NTN through the Online Verification System of FBR

You can verify your NTN through Online Verification System. The FBR’s Online Verification System allows companies and individuals to verify their NTNs online with your CNIC number by visiting https://e.fbr.gov.pk/. You will need an active email address or mobile phone number in order to use the system, so be sure that you have these available when getting started with OVS. If there is any problem regarding your CNIC/NTN status, you will receive an SMS or email alerting you to what needs attention; otherwise, emails may not be needed unless further information becomes necessary at some point down the line!

You can also do it via Email: In case of any query related to e-services please write at] OR Call on 051-111-772-772 Ext: 1910810 during business hours i.e. 0900 Hrs till 1700 Hrs Monday through Thursday (except holidays) Note: No queries related with refunds would be entertained at above-mentioned contact details only E-services related queries would be entertained via email and telephone numbers mentioned above

Why is FBR NTN verification necessary?

If you are a taxpayer, and you have already filed your tax return, then you can verify your NTN from FBR. This is the last step of filing the tax return and will certify that your return has been processed correctly.

To check if your tax return has been filed correctly, do the following:

- Go to FBR’s online portal, which is at www.fbr.gov.pk

- On the left side, click on “Verification”

- In this menu, select “Return Status”

- Enter your NTN (national tax number) in the field provided, and then enter your captcha code below it

Who needs to get NTN?

NTN Verification and how many people need to get NTN in Pakistan?

If you are a person who has any of the following, you should get NTN verification:

- You run a business in Pakistan and are a resident of Pakistan.

- You run a business outside of Pakistan, but also have income from your business within Pakistan.

- You live outside of Pakistan and have a business in Pakistan.

How can you get the FBR Tax number?

You can register yourself through FBR Online itself. There is no need to take the help of a third party regarding this matter. In order to get an NTN number, you have to;

- Register yourself through FBR Online

- Registration through e-portal

- Registration for other taxpayers

What will happen if you don't have an NTN number?

There are a number of situations in which verification is required, but you will know that your transaction requires an NTN number if you receive a message from FBR stating “Your NTN Number is not registered.” This can also happen if there is something wrong with your registration. If this happens, make sure you have completed the steps above and that you have waited until at least 24 hours after completing them to try again.

If you continue to receive errors and think that everything should be working, please contact us , so we can assist you further.

How to get an Income tax return? (FBR Online)

- Get an Income Tax Return Form.

- Fill out the form.

- Submit it to the FBR via email or fax, or you can drop it off at the nearest FBR office in your city.

- You must have an NTN certificate and a CNIC number.

How to access the e-portal and the user guide?

- Accessing the e-Portal

You can access the e-Portal through https://e.fbr.gov.pk/

- Obtaining the User Guide

The user guide contains a detailed description of all steps and can be downloaded from https://e.fbr.gov.pk/downloads/userGuideNTNVerificationSystemVersion1_0_2(FBR).pdf

- Using the User Guide for Support

If you need support, please read the user guide first, as it contains information about common problems and how to solve them. If you still encounter problems, please report these to helpline@fbr.gov.pk. We will try to resolve these problems as soon as possible, and thank you very much in advance for your help with improving our system!

This portal offers a broad range of services for entrepreneurs, traders, and industrialists.

The FBR has offered a broad range of services through the portal. Some key services of the portal include:

- File income tax return

- Make payment

- View and print form

How can we check if our NTN is verified on the FBR site?

It’s easy to check whether your NTN is verified or not. You can do it on the FBR website.

- Go to the FBR homepage and click “NTN Verification.” The link is in small letters on the upper right side of the page, just above where you fill out your NTN number.

- Enter your NTN number into the box that says “please enter your NTN no.” This will make sure that you don’t have to look through a huge list of numbers before finding yours.

- Click “Verify” after entering your NTN number into the box. The website will then tell you if this particular NTN is verified with FBR or not.

Is there any fee for registration on the e-portal?

There is no fee for registration on the e-portal.

The National Tax Number (NTN) registration on the e-portal is free of cost. In addition, there is no fee for non-filers to get their NTN verified, and also there is no fee for filing an income tax return to Pakistan. The Government of Pakistan has waved off all these fees to facilitate taxpayers in obtaining their NTN and filing income tax returns electronically instead of physically visiting a Tax Office or having to go through a middleman/agent.

What is the procedure for Income Tax Return Form Submission on FBR Online Portal?

You need to go to the login page and enter your user ID, password, and token key.

After logging in, you will be redirected to your e-filing dashboard, where you have to click on “select ITR form”.

Next, select the ITR form from the drop-down menu and click on “proceed”.

Finally, fill out the form with the correct information and click on the “submit” button.

If you are doing business in Pakistan and your annual income exceeds 400 Thousand Rupees, then it is necessary that you should get yourself registered under the Federal Board of Revenue (FBR).

If you are doing some type of business in Pakistan and your annual income exceeds 400 Thousand Rupees, then it is necessary that you should get yourself registered under the Federal Board of Revenue (FBR). For this purpose, you will have to obtain a National Tax Number (NTN) from FBR.

NTN registration is a legal requirement for Pakistani citizens and is needed if you want to receive your salary through banking channels or want to file your income tax returns.

Contact Us

Popular Service

Provincial Tax Authorities

Misc. Services

Recent Article

-

Super Tax in Pakistan 2025: How It Affects Your Annual Income and Business Profits

-

Trademark Registration with IPO Pakistan: Intellectual Property Lawyers Can Help

-

NTN Stands For National Tax Number in Pakistan: NTN Registration and Verification

-

NTN Registration Same-day Service for Just Rs. 2,000 Across Pakistan

-

Trademark Registration in Pakistan & FAQ About Trademark

-

Company Registration in Pakistan-SECP Company Name Search

-

Internal Auditing: What Is Internal Auditing? A Comprehensive Guide

-

Business Registration Services in Pakistan-Business Offices in Karachi, Lahore, Islamabad

-

How to Start a Business in Pakistan? Registering LLC Company

-

Best Income Tax Return Filing Service in Karachi - TAXOCRATE (Pvt) Limited

Disclaimer: All information is provided on this portal solely for informational purposes. This portal is not affiliated with the Government website. Please note that this disclaimer also applies to our website, and we may refer to it as ‘us’, ‘we’, ‘our’ or ‘website’. The information on the website has been gathered from various government and non-government sources. We disclaim any liability for errors, injuries, losses, or damages arising from the use of this information. We also disclaim any liability for the availability and authenticity of this information. Our services consist of filling out forms, providing legal advice, and assisting our clients. The departmental processing of the registration forms is not our responsibility. You will have to use a service fee for professionally preparing your application, submitting it to the relevant authorities, and coordinating your application process. You will have to pay any Government fees.