Online FBR NTN Verification by CNIC

How to Online Verify NTN, STRN

NTN Inquiry: Verify Your NTN & STRN Online

Online FBR NTN Verification by CNIC | How to Verify NTN Online | Online NTN Inquiry:

Online FBR NTN Verification by CNIC | How to Verify NTN Online | NTN Inquiry: 3 Simple Ways for FBR NTN STRN Inquiry and online NTN verification. Inquire and check/verify your NTN & STRN from FBR site. Online NTN, STRN inquiry service of FBR is a great facility for taxpayers of Pakistan.

How to Verify NTN/STRN Online

Online FBR NTN verification and Online NTN STRN inquiry: 3 Simple Ways for NTN STRN Inquiry and online NTN verification. Inquire and check/verify your NTN & STRN online from FBR site. Visit e.fbr.gov.pk and inquire/check your NTN, STRN right now. This online inquiry service of FBR is a great facility for taxpayers of Pakistan. There are simple ways for online NTN STRN Inquiry for online check and verify your NTN & STRN from FBR site.

A Guide to Online NTN Inquiry and Verification by CNIC:

There are three simple methods for Inquiry for FBR NTNs and online NTN verification. From the FBR site, you can inquire and check/verify your NTN & STRN. Taxpayers of Pakistan can use the online NTN and STRN inquiry service provided by the FBR.

Online NTN, STRN Inquiry Service of FBR

Online NTN, STRN inquiry service of FBR is really unparalleled. NTN Verification can also be done via SMS. The online NTN verification service of FBR was started a few years back. You can verify NTN in 3 simple ways. People inquire us about NTN verification, FBR registration, online NTN check and verify, Verification of NTN from FBR, NTN verification by CNIC, FBR filer status, etc. So here we provide the easiest way for online NTN verification or online NTN verification, online NTN inquiry, or online verification.

How to Online Check/Verification NTN & ATL Status through SMS

Follow the steps below for your FBR NTN number online verification. There are 3 different ways for users to verify their National Tax Number (NTN) and ATL status – either through the Federal Board of Revenue’s (FBR) official website or through their mobile app, which allows online NTN verification easily. The 3rd way is extremely simple. Just write a text message (SMS) on your mobile phone in this way:

ATL (space)(Your 13 Digit CNIC No without spaces)

Then Send it to 9966

You will get a reply from FBR describing your Name, Registration No (Your CNIC No), and ATL Status report as “Active” or “Inactive”. This will be a verification that you not only have your NTN, but you are a Filer as well.

Online NTN STRN inquiry of FBR. Online FBR NTN Verification by CNIC-How Verify NTN Online|NTN Inquiry

Online FBR NTN Verification by CNIC | How to Verify NTN Online | Online NTN Inquiry: FBR NTN STRN Online

HOW ONLINE FBR NTN VERIFICATION/CHECK CAN BE DONE BY CNIC FROM FBR?

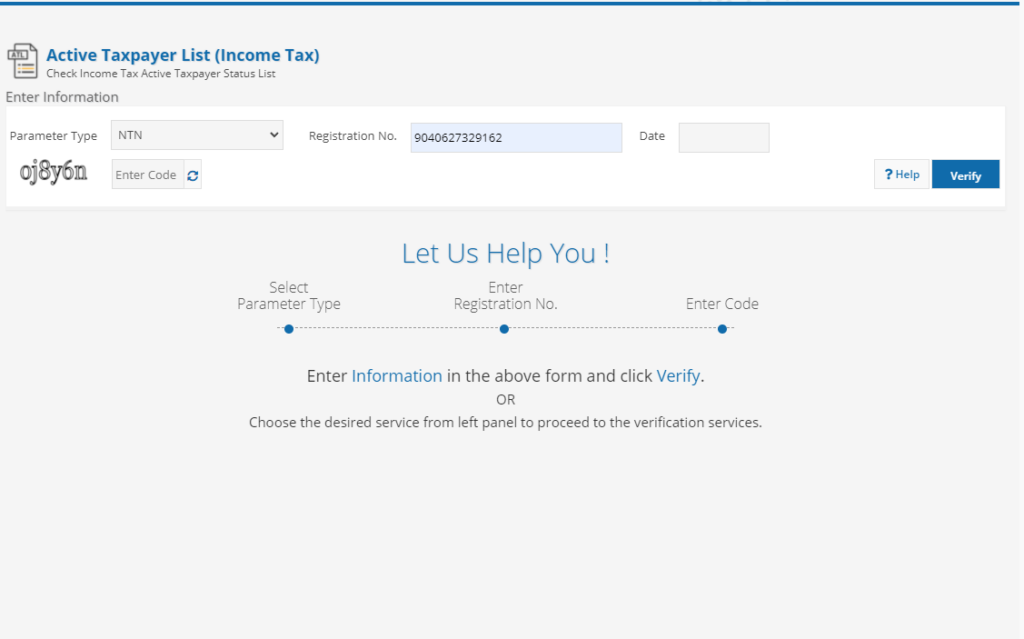

It is quite easy to get online NTN verification from FBR in Pakistan. All that you need to do is go to the FBR’s website in order to obtain the verification of the NTN online. You will notice that the ‘Online Services’ tab will appear when you move your mouse over the left-hand side of the website. You will be redirected to the Online Verification Services web page as soon as you click the “Online Verification Portal”. Various inquiry tabs are available on the left side of the page. Select the NTN/STRN inquiry tab. On the following page, you will find the following information:

FBR NTN Inquiry: Online NTN Verification/Check in Just 2 Steps

For your NTN online verification, you have to take just 2 steps; (1)Visit FBR’s Taxpayer’s Profile Inquiry webpage for your NTN’s verification and put your NTN number or CNIC Number in the required field, and then (2) write the captcha. After putting the correct Captcha, press the “Verify” button, and you will see your complete NTN information on the next screen. You can print this info or save it as a .pdf file, and this is your NTN. You would be amazed how simple and easy is online NTN verification!

Free FBR NTN Inquiry is Easy: Online NTN Verification From FBR at our Karachi, Lahore & Islamabad Offices

We have offices in Karachi, Lahore and Islamabad, where you can obtain the free NTN Verification Service. We have worked with a wide variety of businesses in the past, dealing with a variety of issues. In addition to handling NTN registration and verification processes for individuals and businesses, we handle various legal documents and procedures. Additionally, we will handle your tax returns and NTN registration, as well as your appeals, so you can focus on running your business peacefully. We are available to assist you at any time. Give us a call to receive a free NTN verification today.

NTN is a Number For Taxpayer's Identification: Verify NTN

The NTN is a number issued by the Federal Board of Revenue (FBR), which is used for the taxpayer’s identification purposes. It helps in the documentation and record-keeping of businesses, and also allows them to register with different government agencies and institutions, such as the Employees Old-Age Benefits Institution (EOBI). NTN is also required to file tax returns, an essential component of any business. Check and verify your NTN as there are many benefits associated with having an NTN. For example:

NTN identifies you as a taxpayer so that you can claim any refunds due to overpaid taxes; it helps prevent fraud by ensuring your identity is verified before any transactions take place.

Getting FBR NTN & Online NTN Verification

To get an NTN, you must fill out an online form at FBR’s IRIS website and submit it. The form will ask for basic information such as your name, address, email address, and phone number. You should also include any documentation that may be required with your application, such as proof of residence or other documents that show the source of income that you are declaring on the form. If you do not have this information ready when filing for your NTN application, it may take longer than usual for processing time. After obtaining your NTN number, you can verify it through FBR’s online NTN verification facility.

Online NTN Registration and Online NTN Verification/Check Made Easy!

Through the online IRIS Portal, NTN Registration with FBR (Federal Board of Revenue) has been made very easy by following simple six steps.

The first step is to open the FBR (FEDERAL BOARD OF REVENUE) IRIS portal.

The second step is to select the e-enrollment / registration form

The third step is to fill out the E-enrollment / registration form

The fourth step involves logging into the FBR’s IRIS portal.

The sixth step is to submit Form 181 (Income Tax Voluntary Registration Form 181)

The sixth step is to download your registration certificate

Individuals, AOPs, companies, or foreign nationals must enroll online for NTN registration through the FBR (FEDERAL BOARD OF REVENUE) IRIS portal.

NTN Registration Number will be based on 13 digits of CNIC (Computerized National Identity Card) for individuals.

Upon E-Enrollment for companies or AOPs through FBR’s IRIS Portal, a 7-digit NTN is issued.

Simply Verify Online Your NTN via the FBR Website within a Minute

After registering your NTN, you can online verify your NTN via the FBR website easily within a minute. The NTN number can be entered in the search bar on their website and then ‘searched’. The screen will display your personal information, such as your name, registration date, and address.

Online STRN (Sales Tax Registration Number) Inquiry and Verification

ONLINE NTN-STRN VERIFICATION IS VERY EASY!

Online NTN Inquiry-Verify Your NTN Online

Three Easy Ways for NTN STRN Inquiry and NTN Verification Online: 3 Simple Ways for NTN STRN Inquiry and NTN Verification Online.

From the FBR website, you can inquire and check/verify your NTN and STRN. Now you can inquire/check your NTN, STRN on e.fbr.gov.pk.

Taxpayers of Pakistan can use this service to inquire about their tax status.

FBR has provided several ways for online NTN STRN Inquiry for online verification of your NTN & STRN.

Inquiry services provided by FBR for NTN and STRN are unmatched. SMS-based NTN verification is also available. Several years ago, FBR began offering an online NTN verification service.

People Ask Us About NTN Verification, Online NTN Checking & Verification through CNIC and FBR Filer Status

NTN can be verified in three ways. People ask us about NTN verification, FBR registration, online NTN check and verify, NTN verification by CNIC, FBR filer status, etc. So we are trying to provide you detailed information to guide you.

Thus, we have provided the simplest way to verify NTN online, or to verify NTN online, or to verify NTN online.

FBR Online NTN Verification in Pakistan and FBR NTN Check via CNIC

FBR online NTN Verification for Income Tax in Pakistan and FBR NTN Check via CNIC, NADRA CNIC meaning of CNIC, CTB means Computerized National Identity Card, Online Registration Instructions & NID Card Registration,

FBR online ntn verification in Pakistan is a process of confirming that your NTN number and CNIC (Computerized National Identity Card) are linked with each other. FBR online ntn verification in Pakistan. If you are a citizen of Pakistan and want to get the Ntn Certificate on your CNIC Number or Show your Tax Number from the FBR, just simply visit our website.

NTN is a Unique Number, Issued By the FBR to Identify Taxpayers and File Income Tax Returns

The National Tax Number (NTN) is a unique number issued to every eligible individual in Pakistan. This number permits the taxation of individuals under the income tax laws of Pakistan. The NTN is issued by the FBR (Federal Board of Revenue), and because every citizen must file their income tax returns using their NTN, a CNIC means Computerized National Identity Card is also a prerequisite for this purpose. In addition to verifying that an applicant for any type of business or export license has been issued with his/her proper National Tax Number, the issuance of NTN can also protect businesses from fraud by ensuring that no two people have been erroneously assigned the same number.(Source: Wikipedia)

Online NTN Verification in Pakistan

We are providing online NTN verification in Pakistan to our customers. We have a very user-friendly website, where you can easily find the NTN verification form through your CNIC.

“An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income).”Source: Wikiperdia“

The NTN certificate is considered legal proof of your taxpayer identity

FBR online NTN verification is a not mandatory procedure to obtain the NTN certificate. The NTN certificate is considered legal proof of your taxpayer identity. This certificate is needed while opening bank accounts, opening post office accounts, making real estate transactions, getting visas and any other legal proceedings.

For, FBR online NTN verification by CNIC in Pakistan, you can verify your NTN for the Import and Export items through this portal. Here’s how you can check (verify) your NTN Online instantly.

The process of online verification of NTN is not mandatory

NTN refers to National Tax Number. It is a unique number allotted by FBR for the payment of taxes. The process of verification of NTN is not mandatory for every taxable person in Pakistan. As per the law, every taxable person must register their CNIC with FBR. Once you register your CNIC, you can send a National Tax Number Verification request online through the FBR website or you can get it manually from any FBR office.

Now you can get FBR online NTN Verification through CNIC with complete details. Tax e-filing is compulsory under section 114 of Income Tax Ordinance 2001.

For online NTD processing, you need to verify yourself by CNIC number. All NTDs are subject to verification before processing. The requirement of valid proof of identity is applicable in all cases. The purpose of each type of identification proof is explained below:

NTN stands for National Tax Number. NTN is a mandatory requirement to open a bank account in Pakistan

NTN stands for National Tax Number. As you know this is a mandatory requirement to open a bank account in Pakistan. NTB’s NTN Verification Service allows you to verify your applicant/client’s NTN easily and quickly.

FBR online NTN verification in Pakistan, FBR through CNIC Online NTN Verification Services. The process for this is very simple.

FBR online NTN verification in Pakistan is available for the citizens of Pakistan that have CNIC numbers and want to verify their NTN

FBR online NTN verification in Pakistan is available for the citizens of Pakistan that have CNIC numbers and want to verify their NTN (Non-Tax). FBR is abbreviated as Federal Board of Revenue which is an autonomous body of the Government of Pakistan. The main motive or aim of FBR to collect taxes and government revenue from the people and companies working in Pakistan.

We provide you with the services of FBR online NTN verification in Pakistan. You can keep track of your payments on this website and also get a printout of your tax status.

FBR online NTN Verification in Pakistan

FBR online ntn verification in Pakistan: On the occasion of the holy month of Ramadan, FBR has launched an updated objective e-service portal where citizens can go to verify and file their taxes, at their convenience. The portal consists of all the required applications in a very simple and organized manner.

FBR online NTN verification is the process to check the validity

FBR online NTN verification is the process to check the validity or not of NTN through CNIC. If NTN and CNIC is invalid then the government has the authority to block your bank account or any other NTN validation, if you do not pay the taxes. It may cause big problems in future. We have here a very good service that helps to make you safe from any kind of NTN verification problem without any hassle and without any error.

Online NTN Verification is a process of updating

FBR online new CNIC verification, on this page you can see how to query FBR online NTN Verification on CNIC Number. FBR Online NTN is a process of updating your NTN number after you get a new NTN through CNIC because of duplicate, overwritten, misuse or damage by natural disasters or technological changes.

FBR online NTN Verification in Pakistan topic is completed here..

Contact Us

Popular Service

Provincial Tax Authorities

Misc. Services

Recent Article

-

Company Registration | Company Registration in Karachi, Islamabad/Rawalpindi & Lahore, Pakistan

-

Income Tax and Sales Tax Return Filing Services| Our Expert Corporate Lawyers In Karachi

-

Corporate Lawyers’ Need at Business Hub, Karachi

-

Additional Sales Tax Imposed

-

Comprehensive Guide to NTN (National Tax Number) Registration in Pakistan

-

Income Tax Return Filing in Karachi By Top Tax Lawyers of Pakistan

-

Trademark Registration in Karachi Safeguarding Your Business Identity

-

Taxation Trust Tax Lawyers Consultants

-

Mahr The Dower Money a Symbol of Commitment and Financial Responsibility

-

Calculating Income Tax As Per Income Tax Ordinance 2001

Disclaimer: All information is provided on this portal solely for informational purposes. This portal is not affiliated with the Government website. Please note that this disclaimer also applies to our website, and we may refer to it as ‘us’, ‘we’, ‘our’ or ‘website’. The information on the website has been gathered from various government and non-government sources. We disclaim any liability for errors, injuries, losses, or damages arising from the use of this information. We also disclaim any liability for the availability and authenticity of this information. Our services consist of filling out forms, providing legal advice, and assisting our clients. The departmental processing of the registration forms is not our responsibility. You will have to use a service fee for professionally preparing your application, submitting it to the relevant authorities, and coordinating your application process. You will have to pay any Government fees.