Online NTN Verification By CNIC - How to Verify Online NTN?

How to Verify Online NTN?

Online NTN Verification By CNIC is Possible and Easy

NTN Verification in Pakistan

NTN Verification is a crucial step for individuals and businesses in Pakistan to ensure compliance with income tax regulations. Conducting online NTN Verification through the FBR portal simplifies tax return filings and facilitates accurate record-keeping.

Online NTN Verification At FBR's Digital Plateform

Online NTN Verification streamlines the process of income tax compliance in Pakistan. By leveraging the FBR’s digital platform, individuals and businesses can conveniently verify their NTN status for accurate tax return filings

Ensuring the Accuracy of NTN Number

Ensuring the accuracy of your NTN number is crucial for income tax compliance in Pakistan. Conducting online NTN number verification through the FBR portal simplifies tax return filings and fosters transparency.

Is the Online NTN Verification By CNIC Possible?

Yes, it is possible to get your NTN Verified online by your CNIC number through FBR web portal.

How to Verify Online NTN?

Online NTN Inquiry is easy. Online FBR -NTN Inquiry or Online Verification requires. Online NTN Verification From FBR is very easy. You can verify your NTN Number online or from the FBR office. If you are unable to do so, but still want to verify your NTN, tell us your CNIC and we will check your NTN Online within minutes.

Who Issues NTN in Pakistan?

In Pakistan, NTNs (National Tax Numbers) are the unique numbers that are allotted to citizens by the Federal Board of Revenue (FBR) for the purposes of tax and sales records. Additionally, NTN is required for bank transactions, property purchase/sale, automobile purchase/sale, etc.

Wondering How To Check/Verify Your NTN online?

Most people often inquire about the online checking procedure for NTN verification from FBR. There really is no need to be confused about this, Taxocrate is here to help you with its services regarding NTN registration and verification, Company Registration, Firm Registration, etc. Wondering How To Check Online NTN Verification from FBR? Taxocrate PVT LTD can assist you with your query. There are simple methods for online NTN verification from FBR listed below.

How to Check Online NTN – Verification

Method 1: Contact Us

You can check your NTN’s verification through your phone.

Just give us a call or Whatsapp us at 0300-3029093 or send us your mail at taxocrate@gmail.com along with your CNIC number.

The representative of Taxocrate will help you inquire about your NTN’s verification within seconds. online-ntn-verification-from-fbr

Register your NTN now for free by contacting Taxocrate PVT LTD. We are offering FREE NTN Registration for all citizens living in Pakistan.

Become an active taxpayer now.

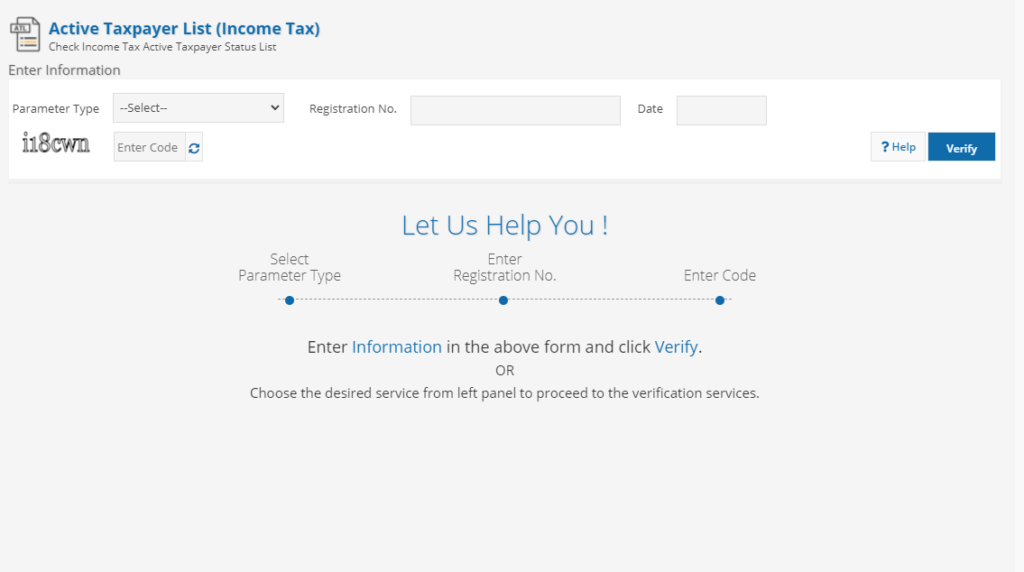

Method 2: Online NTN Checking & Verification

Go to the e-portal of the FBR’s site “https://e.fbr.gov.pk”.

Select “Taxpayer profile info” from the left menu bar.

To verify your individual’s NTN then Select ‘NTN’ or ‘CNIC’ from the <Parameter Type> section.

Type your CNIC number in the <Registration No.> section then click “Verify”

If you are a foreigner then select “Passport No” from the <Parameter type> section.

A company or Incorporation’s NTN can be checked by selecting the “Comp/Reg No” from the <parameter type> section.

Those who belong to Azad Jammu Kashmir (AJK) or want to check the Active Taxpayer List (income tax) or (sales tax) can go for it in the left menu bar accordingly.

Method 3: NTN Verification Through SMS

For Individual Active Taxpayer: Type “ATL (space) 13 digits CNIC number” and send it to 9966.

For AOP and Company status: Type “ATL (space) 7 digits NTN number” and send it to 9966.

For Azad Jammu Kashmir (AJK) Active Taxpayer Status:

For Individual: Type “AJKATL (space) CNIC number” and send it to 9966.

For Company: Type “AJKATL (space) 11 digits NTN” and send it to 9966.

Why NTN Verification in Pakistan is Nevessary?

NTN Verification in Pakistan is a vital process for individuals and businesses to ensure compliance with income tax regulations. Online NTN Verification through the FBR portal simplifies tax return filings and enhances transparency.

Add Your Heading Text Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.