Super Tax in Pakistan 2025: How It Affects Your Annual Income and Business Profits

The taxation landscape in Pakistan has always been dynamic, with new policies introduced every year to regulate revenue collection. One such policy that has caught the attention of salaried individuals and business owners alike is Super Tax.

In 2025, Pakistan’s revised Super Tax will change how income and profits are taxed. In Pakistan, the super tax is typically levied at rates such as 1% to 4% on high-earning businesses, depending on the sector and income levels. It will affect both high earners and businesses. Individuals with large salaries and business owners will need to understand these changes. Knowing how it works can help in managing taxes better.

This guide explains Super Tax in Pakistan. You’ll learn how it works and how it impacts your income and profits.

What is Super Tax in Pakistan?

Super Tax is a special tax charged on people and businesses with high incomes. The government uses it to collect money and cover budget gaps. It started in 2015 as a short-term tax to help displaced people. But over time, it became a regular tax. The rate has changed several times, depending on the economy.

Who is Liable to Pay Super Tax?

Super Tax applies to

- Individuals earning above a certain income threshold

- Corporations operating in Pakistan

- Specific industries facing higher tax slabs

This tax aims to ensure that higher-income groups and profit-generating businesses contribute more towards national economic stability.

Super Tax Rates for 2025 – What’s New?

The government changed the Super Tax structure for 2025. The goal is to create a fairer system, boost revenue, and keep the economy stable. New tax slabs now apply to both individuals and businesses. Those with higher incomes will pay more.

The government changed tax rates due to inflation, budget gaps, and new economic policies. They want to boost revenue but not put too much pressure on taxpayers. Still, higher taxes make things harder for wealthy individuals and big businesses. Smart tax planning is now more important than ever.

Super Tax Rates for Salaried Individuals in 2025

The tax rates proposed through FB remain the same. Below is an illustration of how these tax rate changes, along with the surcharge and super tax (if applicable), will impact taxpayers.

Taxable Income (PKR) | Effective Tax Rate(%) |

15,000 | 1.25% |

40,000 | 1.82% |

65,000 – 115,000 | 2.71% – 3.19% |

127,500 – 270,000 | 3.11% – 2.70% |

616,500 – 7,196,500 | 5.14% – 3.60% |

10,696,500 | 3.57% |

Super Tax Rates for Non-Salaried Individuals / AOPs in 2025

The tax rates proposed in FB remain the same. However, for professional firms that cannot incorporate due to legal restrictions, FA has lowered the maximum rate from 45% to 40%.

Below is an illustration of how these changes impact non-salaried individuals and AOPs (excluding professional firms). It also includes the effect of surcharge and super tax where applicable.

Taxable Income (PKR) | Effective Tax Rate(%) |

15,000 | 1.88% |

95,000 – 125,000 | 3.96% – 3.91% |

205,000 – 525,000 | 5.13% – 6.56% |

725,000 – 1,374,000 | 7.25% – 11.45% |

1,809,000 – 72,134,000 | 12.06% – 14.43% |

144,634,000 | 14.46% |

These rates indicate that AOPs with high profit margins will see a significant impact on their revenue stream.

What About Super Tax for Businesses & Corporations?

This mainly covers tax rules for individuals, including salaried and non-salaried people (or AOPs). It does not have a separate section for Super Tax rates on businesses and corporations. While it includes detailed tables and analyses for personal tax, corporate taxation lacks the same level of information.

Omission of Industry-Specific Data

Unlike some other documents or official circulars, the PwC memorandum does not include industry-specific data that many business owners rely on for tax planning. For example, you might have seen detailed rates such as:

- 10% Super Tax for the Banking Sector

- 4% Super Tax for industries like Oil & Gas, Telecom, and Fertilizer

- 3% Super Tax for the Textile & Manufacturing sectors

These exact rates matter a lot for businesses. They affect net profits, pricing plans, and financial decisions.

These tax rates play a key role in profits, pricing, and financial planning. Businesses rely on official updates from the Federal Board of Revenue (FBR) for accurate details. The FBR Circular is the main source, it changes with new fiscal policies and lists tax rates for different industries. This document gives businesses the latest information they need for tax calculations and financial decisions.

How to Calculate Your Super Tax Liability in 2025

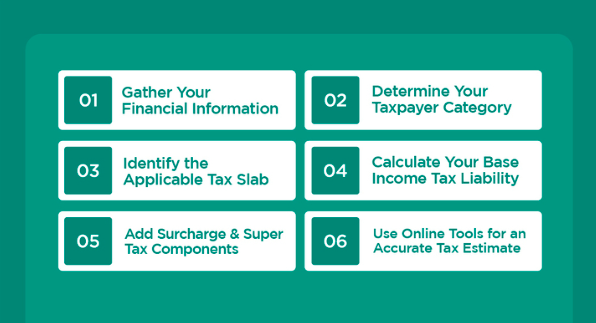

Below are six major steps to accurately calculate your Super Tax liability for 2025:

Step 1: Gather Your Financial Information

Collect all relevant financial data including your annual taxable income, deductions, and any other income sources. Ensure that you have the latest figures for salary, business profits, and other applicable earnings.

Step 2: Determine Your Taxpayer Category

Identify whether you fall under the category of a salaried individual or a non-salaried individual (or a business entity). This is crucial as different tax slabs and rates apply depending on your taxpayer category.

Step 3: Identify the Applicable Tax Slab

Check the official tax tables to find your income bracket. If you’re an individual, compare your taxable income with the progressive tax rates. Businesses should look at industry-specific guidelines if they apply.

Step 4: Calculate Your Base Income Tax Liability

Once your tax bracket is known, calculate your basic income tax based on the prescribed rates for your income range. This forms the foundational tax liability before any additional levies are added.

Step 5: Add Surcharge and Super Tax Components

If your income exceeds certain thresholds (e.g., for salaried individuals or specific business profits), apply the additional surcharge and Super Tax rates as stipulated by the relevant tax regulations. This step requires careful calculation to ensure all extra percentages are correctly accounted for.

Step 6: Use Online Tools for an Accurate Tax Estimate

Finally, leverage online Super Tax calculator specifically designed for Super Tax computations. These tools allow you to input your detailed income figures and automatically calculate your overall liability, ensuring precision and saving you time.

Strategies to Reduce Super Tax Legally

While Super Tax is a mandatory component of the tax system, there are several legal methods available to help mitigate its impact:

1. Tax Exemptions and Deductions

One effective approach is to maximize the use of available tax exemptions and deductions. By investing in tax-saving instruments, such as

- government bonds

- retirement funds

- specific savings schemes

you can lower your taxable income, thereby reducing the overall tax burden.

People and businesses save money by claiming the right expenses. Companies can deduct costs like salaries, rent, and utilities. Daily expenses that follow the law also count.

For individuals, deductions may be available for expenses related to health, education, and charitable donations. Thorough documentation and adherence to regulatory guidelines are essential to ensure these deductions are accepted by tax authorities.

2. Strategic Income Distribution

High-income earners can benefit significantly from strategically distributing their income across multiple sources. By diversifying earnings, whether through

- Salary

- Dividends

- rental income

- other channels

it is possible to avoid concentrating all income in the highest tax brackets, which typically attract the highest tax rates. ‘

Similarly, businesses can optimize their tax liabilities by dividing profits across various subsidiaries or business segments. This approach not only helps in reducing the effective tax rate but also encourages a more balanced financial structure.

3. Legal Tax Planning

Engaging in proactive and legally sound tax planning is crucial for minimizing Super Tax liabilities. Consulting with experienced tax professionals or financial advisors can provide valuable insights into the most effective strategies for your specific situation.

These experts can help identify all possible exemptions and deductions, and advise on how to structure income or corporate finances in the most tax-efficient manner.

Legal ways like corporate restructuring help reduce tax liabilities. Businesses may reorganize, merge operations, or set up holding companies when needed. These strategies work within the law and help taxpayers use every legal option to lower taxes while following all rules.

These strategies help people and businesses handle taxes better. They lower the burden of Super Tax, keep everything legal, and improve financial stability.

Conclusion

The Super Tax in Pakistan 2025 will hit both salaried individuals and businesses. High earners will have less take-home income. Companies will see profits shrink. Tax planning becomes crucial. Smart strategies can help save money. Online tax calculators make planning easier. Keeping up with tax changes helps avoid financial stress. Being proactive is the best way to adjust.

For detailed tax planning, consider consulting a tax expert to explore all available exemptions and legal strategies.

Contact Us

More Resources

Provincial Tax Authorities

Misc. Services

Recent Article

-

Required Documents for Income Tax Return Filing in Karachi

-

How to Register a Pvt Limited Company in Pakistan

-

The Ethics of Taxation: Building a Stronger Pakistan Through Legal Compliance

-

FBR Notices and You: How to Respond to an Assessment Amendment Legally

-

The Future of E-Bility: What Every Logistics Business in Karachi Needs to Know

-

Filer and Non-Filer | Who is a Filer in Pakistan?

-

Income Tax Return Filing Experts in Pakistan

-

Super Tax in Pakistan 2025: How It Affects Your Annual Income and Business Profits

-

Trademark Registration with IPO Pakistan: Intellectual Property Lawyers Can Help

-

NTN Stands For National Tax Number in Pakistan: NTN Registration and Verification

Book Appointment